Stock Market is considered as a great instrument to build wealth. However, you might discover many experts suggesting to use long term investing approach to build wealth. In fact, many Popular Big Investors like Rakesh Jhunjhunwala, Radhakishan Damini, Raamdeo Agrawal, and Institutional Investors also prefer long term investment strategy over short term. Why do they prefer so?

In This Article

Long Term Investment Vs Short Term Investment

Reasons why Big Investors prefer Long Term Investing approach in Stock Market

- Investments made by them have a Bigger Impact on Share Price

- Reasons for which Shares were purchased might not happen overnight

- Magic of Compounding in Stock Market

- No need to Modify Investments with daily Market Volatility

- To benefit from Growth Company, Long Term approach could be required

Long Term Investing is better than Short Term?

Why do People invest for Long Term in Shares?

Pros and Cons of Long Term Investment

In this article, we are going to see the reasons behind why Big Investors adopt Long Term approach in Stock Market and suggest to take similar approach to other small investors. Before, we talk about that, let’s first see the basic difference between Long Term and Short Term Investing.

Long Term vs Short Term Investment

In Short Term, you put the money in a particular stock considering that it will give your expected returns in a short period of time i.e Short term. Time period of Short term could be anywhere between few months to upto 1 year. In some cases, it could be 1-2 years too.

When you have made an investment in shares and you would be ready to wait for the years until your investment doesn’t gives you any good return, it would be considered as a Long Term Investment. Whether you are ready to wait for 5 years, 10 years or 20 years, all would be counted as a Long Term Investment.

We generally tag those investments for long term where investors are ready to wait for atleast 3 years. In some cases, long term could be just 1+ year time frame also.

So, that was the quick difference between Short Term and Long Term Investing. Let’s now come to our main topic and see why Big Investors prefers Long Term Investing Approach in Stock Market.

Why Big Investors prefer Long Term Investment over Short Term?

1) Let Compounding play its role in Long Term!

As per Albert Einstein (famous physicists), compounding is one of the Eighth Wonders in the World. If you know some about finance, you may know about the magic of compounding. If you don’t know, let me tell you.

Compounding is a kind of phenomenon that happens when something keeps growing in the long term. As the asset keeps growing, the amount of growth of an asset also keeps increasing with the time. To understand it, let’s see an example.

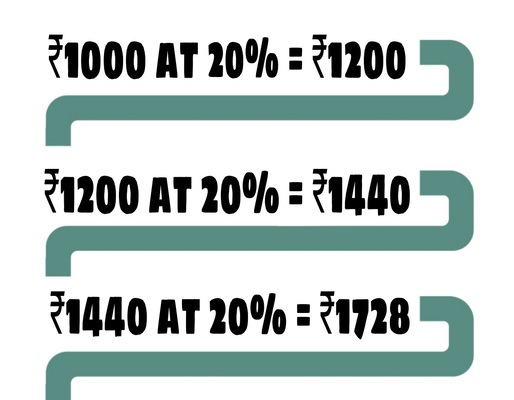

Suppose, you have invested ₹1000 in ABC Stock. In the first year, share price grew by 20% means your invested money would have increased by ₹200 to ₹1200 (₹1000 + ₹200). In next year, if your investment again grew by 20%, then this time, your investment value will not increase by ₹200. It will increase by ₹240 (20% of ₹1200).

You are not doing anything else. But the rate of increase in your investments will keep rising if the asset continued to grow with the passage of time. That is what we call the magic of compounding.

To let the compounding work, it requires 3 things

- The Original (Principal) Investment remain invested

- The Reinvestment of earnings which means you shouldn’t take out the earnings made in the first year or any period and should keep it invested.

- And Time. The more time you give your investments, the more you may be able to accelerate the rate of increase in your investments.

That is among the key reasons why Investors loves to invest in an asset with Long Term Horizon. If an asset or company keeps rising with even 12% rate annually (which initially may look low), this can also turn into a Big Return if money invested for the long term.

2) No need to keep Modifying Investment with every Market Volatility!

Stock Markets are always very volatile. Timing them and predicting where they will move on a particular day is not easy. In fact, it is very hard to do. Using Long Term Investing approach, you are not required to do so!

You can simply invest the money and wait until the company and its share doesn’t hits your Target Levels. An Investor doesn’t requires to get indulge in the daily volatility of share price.

Big Investors are not interested in how many ups and downs share price took to reach the price. They are targeting a point/price of share where they expect it to reach if proper time is given like Orange circle in below stock.

Though holding Stocks for Long Term is not an easy task, but they (Big Investors) are specialised in this.

When the share price is not moving but others are moving which we don’t own, it might promt us to sell our share and shift to a better stock. In some cases, it is possible that even after giving sufficient time to the stock, share price doesn’t moves due to poor performance of the company. But if you have picked a right company, its shares might reach your reasonable Target Levels in future.

3) To Benefit Maximum from the Growth in Company, Long Term approach could be required!

Many Big Investors take entry into Growth Stocks to benefit from the ongoing growth in the company. However, it is not like they will take entry today and take exit within a month! This way, they can’t earn money from the stock.

To Get and Earn the Maximum benefit from the Growth stock, proper time would be required to be given to the stock. It could be required to give atleast few years to the stock so that the company can grow well in the given time frame and share price can react on it positively. This means, Long Term Investing Approach could be required to gain from the stock.

When a company is growing, Investors would like to be the part of their growth journey until growth doesn’t starts peaking out. When the growth would start getting peaked, this could be the time to take exit from the stock.

4) Investment by Big Investors have a bigger Impact on share prices!

When a small investor buys or sells some shares of a particular stock, there is hardly any impact of it on the share price as thousand of other small investors are trading in that stock. However, when a big investor like Rakesh Jhunjhunwala or Institutional Investor would make any buying and selling in a particular stock, it might have a deeper impact on the share price.

Say an Institutional Investor wants to purchase 1,00,000 shares of ABC Stock. If this investor can get this shares through a single/few existing shareholders of the company, investor wouldn’t need to purchase the shares from exchanges. Investor would be able to get this shares at a single pre decided price. However, if no one is offering shares, investor will have to purchase the shares from exchanges.

After some rough calculations, it came to know that if someone wants to buy 1,00,000 shares of ABC stock, the person will be able to do so upto ₹150 share price. Means upto ₹150, investor would be able to gather 1,00,000 shares from exchanges.

So, investor started purchasing the shares and share price actually reached ₹150. Let’s assume the average cost of this purchase as middle price i.e ₹125 (of ₹100-150).

In next 3 months, stock price of ABC has reached ₹170 due to positive market and better results announced by the company. In another 6 months, stock has reached ₹200. After almost 2 years since the investor entered in the stock, ABC has now reached ₹300 per share.

At this point of time, investor decides to take exit from the stock. As per calculations, he came to know that if he starts selling its shares at ₹300 and continued to sell, share price will decline to ₹200. So, he starts selling and share price reached to ₹200 till the selling was over.

When investor sold its shares, stock declined by total ₹100. We will again take the middle number as average price of the selling which is ₹250 per share.

Investor’s average purchase price was ₹125 and average selling price came to ₹250. So, how much he earned profits?

Investor earned ₹125 per share profit but in 2 years. If he has sold his shares after 6 months when the share price was just ₹200, he couldn’t get much from the stock.

As we observed, if investor starts selling his shares in the market, share price is expected to decline by ₹100. From ₹200 per share rate, ₹100 decline means share would have came down to ₹100 per share again. As we are taking middle number as the average price, in this case, average price would have come just ₹150. Through ₹125 as average price for purchasing, investor would have earned only ₹25 per share profit (₹150-125).

In the same stock, if small investor had taken an entry, he could buy all desired number of shares at or around ₹100 easily (as their amount of shares wouldn’t be significant). If the small investor decided to take exit at ₹300, then again he would have been able to easily take exit at ₹300.

In this example, figures that have been taken doesn’t belongs to any stock. But that is exactly what happens in stock market. When a Big Investor has taken entry into any stock, he needs to give a proper time to the stock so that other investors could join the stock at higher levels when the company reports better earnings and share price could rise significantly. And that time would not be a short period.

It would required a long term horizon to let happen. Otherwise, as we saw, if the big investor takes entry and exit from a stock within a just few months, he wouldn’t be able to earn anything.

So, that is one of the reasons why Big Investors feel comfortable in Long Term Investing. This reason is not useful for the small investors as they can easily take entry and exit from a stock without impacting the share price much. However, other reasons surely suite small investors too.

5) The Reason for which Money was invested in a stock might not happen overnight!

When an Investor invests money in a stock, he could be doing so because

1) He expects some level of growth in the earnings of company. Say if the current earnings of ABC company is ₹10 crore per year, investor might be predicting that company still has not seen any considerable growth and in coming years, ABC company has potential to reach ₹100 crore earnings per year. Considering this fact, he would hold the stock until his prediction doesn’t turns true.

2) Another reason could be that he expects a turnaround for the company. Say XYZ company is currently incurring losses to the tune of ₹100 crore annually and due to this, their valuations in stock market are extremely down. But the investor expects that in future this thing will change and XYZ would earn profits. Until the turnaround doesn’t takes place, valuations wouldn’t rise. Therefore, investor would hold the stock until this thing doesn’t happens. When successful turnaround would be there, valuations of XYZ company would be much higher than current.

In both of the cases above, things wouldn’t happen or progress overnight! Investors have invested in the stock and are now ready to hold the shares till their expectations from company are not met.

Here, they have invested the money for long term as they don’t know about when their expectations would actually turn true and how long they might have to wait.

So, that were some of the main reasons why Big Investors prefer Long Term Investing approach over Short Term. Whenever, you are required to give sufficient time to your investments, it is likely to turn into your Long Term Investments.

“Stock Markets are one of the places where you get rewarded for doing nothing in the short term”

So, Long Term Investing is better than Short Term?

Long Term Investment can be really fruitful if money is invested in a Right stock. However, it doesn’t means Short Term Investment is not good.

As we discussed in the first point, for Big Investors, it is always be very hard to make money through short term investment in listed stocks. Their buying and selling can bring some significant changes in share prices. Therefore, they need to adjust their strategy as per this.

But small investors who are not dealing in few crores are easily able to take entry or exit from even low liquid stocks. What are low liquid stocks?

Low liquid stocks are those where number of buyers and sellers are comparatively lower. Their trading volume is low which makes them prone to see significant share price changes in case of any small buying by a Big Investor.

The quantity they (Small Investors) desire to buy maybe able to buy in a single price which is not in the case of an investor who is going to deal in a big quantity. Due to this, small investors are capable to earn better returns.

In Stock Market, Short term and Long Term both opportunities would keep coming. However, big investors may not be able to utilise the short term opportunities easily. Whereas, small investors can easily utilise both opportunities. Therefore, for Small Retail Investors, short term investment is also a good strategy as like Long Term, if investment decisions are taken wisely.

Why do People Invest for Long Term?

As we discussed above, through Long Term Investments, they can get the benefits of

- Compounding: To gain maximum from the compounding, we need to remain invested for a longer period of time. To gain Big, time also required to be given Big.

- Less need of transactions: Through Long Term Investments, you are not required to adjust your investments as per daily market volatility. You can Buy Right and Sit Tight. Making frequent changes in your investments also incurs some charges. Making transactions in Stock Market are not free.

- Less difficult to handle: Gaining from Daily Market volatility is generally a hard task. Whereas, an investment made in a stock/group of stocks and then keep holding them until the targets are not achieved is less difficult to handle.

These are the common reasons why people invests for Long Term.

Pros and Cons of Long Term Investment

We have already seen the Advantages (Pros) of Long Term Investment in Stock Market above. Is there any Disadvantages (Cons) too of Long Term Investment?

Every thing has its own plus points and negatives. Likewise, Long Term Investments too have few disadvantages. What if your stock never moved even after giving it a sufficient time period?

It happens in stock market as every stock that you are picking today might not able to rise in future. Due to tepid or nil growth expectations, some stocks might never be able to gather any investor attention! If this happened, no compounding would work and you wouldn’t be able to earn any good return on your investments.

To overcome from this risk, a diversified portfolio (investing money in multiple category of stocks) is build when the investment approach is long term. If most of the stocks performed well but few doesn’t moved as per your expectations, it wouldn’t restrict your portfolio from Growth.

.

.

.

.

.

So, that is the end of this article.

Long Term Investments are good and they offers a lot of benefits. But when the investor is small, both short term and long term investment opportunities can be easily utilised in stock market. That is one of the reasons why Popular Individual Investors like Rakesh Jhunjhunwala were once a trader.

However, if you have invested some money in a stock for long term, don’t let it turn into your short term investments until there is no change in the factors that had forced you to buy the stock!

Good Luck : )